Blog /

Andium Raises $21.7 Million in Series B Funding Led by Aramco Ventures to Cut Greenhouse Gas Emissions

NEW YORK CITY, USA—October 29, 2024

Andium (www.andium.com), an expert in Industrial Internet of Things (IIoT) remote-field monitoring and communications technologies, today announced its $21.7 million Series B funding close led by Aramco Ventures (www.aramcoventures.com), the corporate venture arm of one of the world's largest integrated energy and chemicals companies. Joining the round are existing investors Climate Investment, Intrepid Financial Partners, and prominent individual investors including former Citadel CIO, Thomas Miglis. Following the company's $15M Series A in 2021, this investment brings the company's total funding to over $40 million.

The new capital will accelerate Andium's global expansion, including scaling operations across oil and gas basins in the U.S. and the Middle East. It will also reduce technology and equipment costs, support ongoing research and development, and enhance the range of services Andium offers in industrial automation and emissions monitoring.

“This investment is a powerful endorsement of our platform, which will be pivotal as we enter our next stage of growth,”

said Jory Schwach, Founder and CEO at Andium.

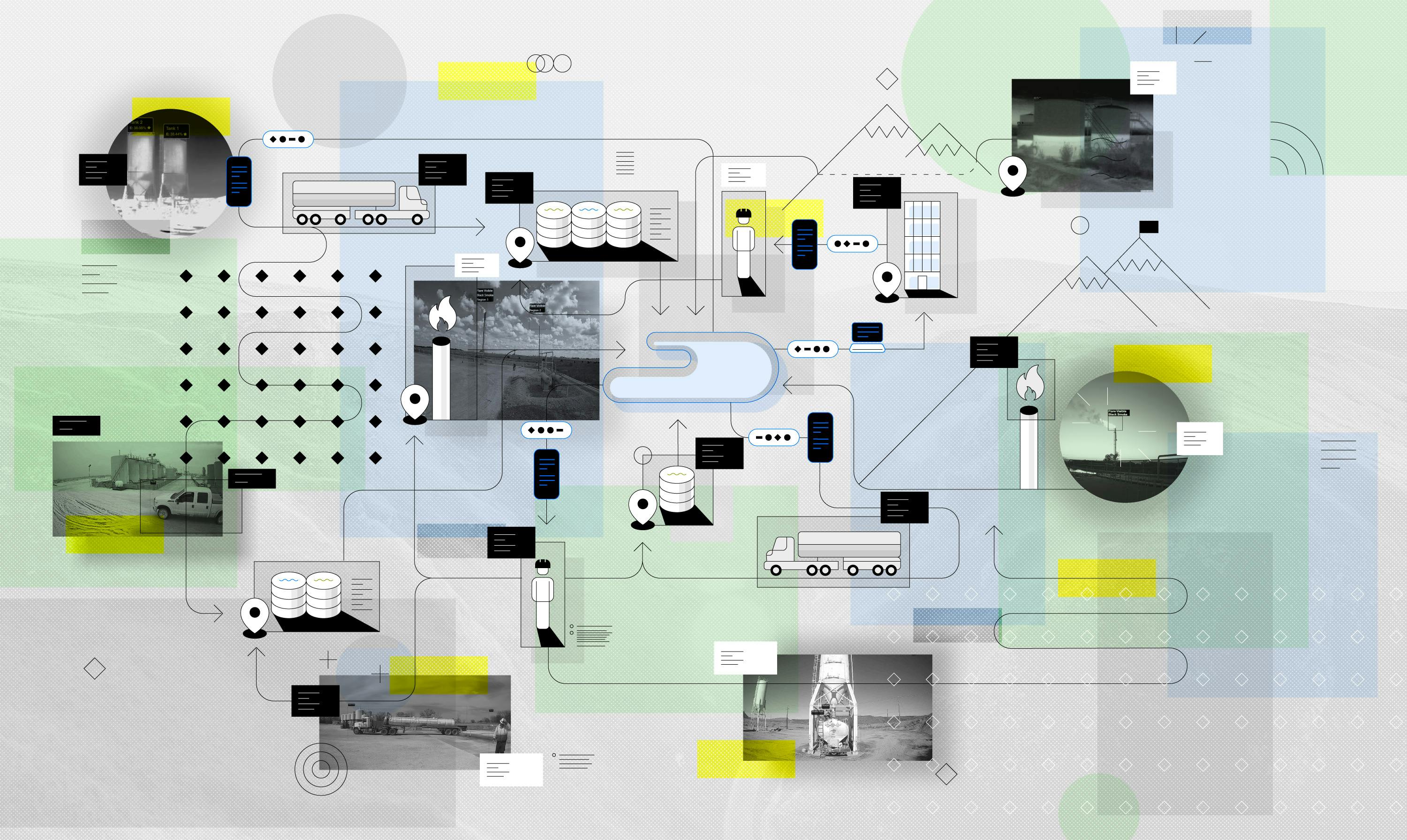

"Our end-to-end Operating System, which monitors and provides real-time, verifiable emissions data from remote locations, has already been proven to lower operational costs, cut emissions, and improve safety—helping energy, mining and waste companies meet their net-zero and zero-harm goals."

Andium combines AI-powered software with on-site sensors and cameras to provide a comprehensive, real-time solution for remote field monitoring. This enables accurate tracking of environmental, social, and governance (ESG) metrics, detecting issues like methane leaks, fires, and equipment malfunctions. By providing instant insights, Andium helps companies ensure continuous asset performance and regulatory compliance. The technology has already proven effective in reducing greenhouse gas emissions by up to 65 percent per location while lowering field operational costs by up to 45 percent for major energy companies like BP and ConocoPhillips. Andium's real-time monitoring automation reduces windshield time by over 80 percent, addressing labor challenges, empowering workers, and improving efficiency across remote locations.

Aramco Ventures' $1.5 billion Sustainability Fund supports innovative technologies that reduce Scope 1 and Scope 2 greenhouse gas emissions. This aligns with Aramco's goal of achieving net-zero emissions by 2050. Bruce Niven, Executive MD at Aramco Ventures, said,

“We are delighted to be partnering with Andium. This technology platform has the potential to reduce fugitive emissions as well as provide operational benefits in a variety of applications. It is an elegant and cost-effective solution.”

Andium’s funding comes at a critical time. As COP29 approaches next month, methane emissions will take center stage, given its impact on warming the planet and significant contribution to climate change. Methane is a potent greenhouse gas that traps 80 times more heat than carbon dioxide over a 20-year period. Approximately 60 percent of methane emissions stem from human activities, with the energy sector, primarily fossil fuels, accounting for over one-third of these emissions. As methane reduction becomes a regulatory priority, Andium’s solutions will play a crucial role in helping companies meet emission reduction targets. At scale, Andium’s technology has the potential to contribute to lowering global temperatures. Errand methane releases from industrial facilities are contributing to more than a third of a degree Fahrenheit (approximately 0.14°C) in global warming.

Endorsements from Participating Investors:

“Andium’s platform provides a critical and cost-effective tool for energy companies looking to meet their ambitious emissions reduction goals in an increasingly complex regulatory landscape. By providing real-time, verifiable emissions data, Andium empowers operators to take informed, actionable decisions that reduce costs and deliver impact today. We’re pleased to continue supporting Andium’s growth as it scales its transformative solutions globally.”

Marc van den Berg, Global Managing Director for Investments, Climate Investment.

“We are proud to support Andium as they push the boundaries of industrial innovation to address critical issues facing many industries, particularly energy. This investment aligns with our venture fund’s strategy of investing in, and partnering with, truly transformative companies driving the future of sustainable energy and industry.”

Skip McGee, Co-founder and CEO of Intrepid Financial Partners

“Andium's innovative IIoT platform is a game-changer for industries striving to reduce their environmental impact. As an early investor, I've been consistently impressed by the team's ability to deliver cutting-edge solutions that drive tangible value for customers through emissions reduction and operational efficiency gains. Andium is at the forefront of the sustainability revolution, and I'm excited to continue supporting their growth as they scale globally."

Tom Miglis, former CIO of Citadel and current Investment Partner at Nyca Partners

About Andium:

Andium is on a mission to create a more sustainable future. To achieve this, the company has developed an end-to-end Industrial Internet of Things platform to arm the most consequential markets with the tools they need to reduce emissions, improve safety, and boost operational efficiency. By providing real-time, verifiable emissions data and comprehensive environmental, social, and governance (ESG) monitoring, Andium enables companies to make data-driven decisions that drive meaningful change. From energy and mining to waste management, Andium is at the forefront of the sustainability revolution, elevating critical voices and building a better world for generations to come. Andium is backed by a diverse group of investors including Aramco Ventures, Climate Investment, and Intrepid Financial Partners, raising a total of $40 million.

This announcement contains forward-looking statements that reflect Andium's expectations regarding our growth trajectory, operational milestones, and future product enhancements. These statements are grounded in our current plans and industry outlook but carry inherent risks and uncertainties. As Andium embarks on this next phase, supported by recent funding, we aim to drive significant advancements in site monitoring technology, expanding our capabilities to assist oil and gas companies in meeting regulatory requirements and reducing emissions. Actual results may differ due to various factors, including industry changes, regulatory shifts, and evolving customer needs. Andium disclaims any obligation to update these forward-looking statements, except as required by law.

To learn more about the company, visit www.andium.com.

About Aramco Ventures:

Aramco Ventures is the corporate venturing subsidiary of Aramco, the world's leading fully integrated energy and petrochemical enterprise. Headquartered in Dhahran with offices in North America, Europe and Asia, Aramco Ventures strategic venturing programs invest globally in start-up and high growth companies with technologies of strategic importance to its parent, Aramco, primarily supporting the company's operational decarbonization, new lower-carbon fuels businesses, and digital transformation initiatives. Aramco Ventures also operates Prosperity7, the company's disruptive technologies investment program.

Visit aramcoventures.com for more details.

About Climate Investment (CI)

Climate Investment is an independently managed specialist investor focused on accelerating capital-efficient decarbonization of heavy emitting sectors. Operational since 2017, its team of investment and technology professionals has built a portfolio of 39 technology and business model innovations across energy, transportation, buildings and industry. Collectively, its Catalyst portfolio delivered 95 MT CO2e of cumulative greenhouse gas reduction in the period 2019-2023. Climate Investment was founded by member companies of the Oil & Gas Climate Initiative (“OGCI”). They have invested in Climate Investment funds and deployed many of its portfolio innovations, supporting their early commercial development.

Visit www.climateinvestment.com.

About Intrepid Financial Partners

Intrepid Financial Partners is the leading energy-focused merchant bank that provides investment banking and investing management services. Intrepid’s leading boutique investment banking business provides independent and best-in-class merger and acquisition, restructuring and capital markets services to the traditional energy and energy transition sectors, and has advised on ~$200 billion of transactions since its founding in 2015. Intrepid’s investment management business makes principal debt and equity investments through its managed funds. Current strategies include private equity, infrastructure and venture capital across traditional energy and energy transition.

Visit www.intrepidfp.com.

Media Contact:

PUBLIC RELATIONS FOR ANDIUM:

Salomé Bronkhorst and Leah Taylor at Cast Influence

CONTACT:

PRESS KIT:

Available in Dropbox: videos, site images, logos, and more.

Related Downloads

Contact Us

Reach out for more information and we’ll be in touch soon.